CCB Financial Leasing Co., Ltd. (referred to as "CCB Financial Leasing"), a wholly-owned subsidiary of China Construction Bank Corporation, was incorporated on 26 December 2007 with a registered capital of RMB 11 billion and is headquartered in Beijing. It is one of the first financial leasing companies approved by the China Banking and Insurance Regulatory Commission.

As one of the major platforms of CCB's comprehensive operation, CCB Financial Leasing has always focused on the development strategy of shareholders since its establishment, made full use of the characteristics of financing and funding, actively fulfilled its social responsibilities, supported the development of the real economy, dedicated in its advantageous business fields, steadily promoted its international layout, continuously explored market shares and innovated products, endeavored to serve national construction, prevented financial risks, participated in international competition, and provided diversified and specialized financial leasing services to customers. In its new stage of development, CCB Financial Leasing adheres to its principle of seeking progress in a steady manner through internal market expansion and external profit assurance, implements its new development concept and new financial actions to advance green leasing transformation, inclusive leasing transformation, and digital transformation, returns to its original roots of leasing, strengthens its comprehensive operating ability and refines its management level. With the acquisition of international A/A1/A rating from S&P/Moody/Fitch, CCB Financial Leasing is committed to create a new situation featuring double-circulation, double-curve and high-quality development.

1157.76亿元

租赁资产

1246.69亿元

资产总额

7.56亿元

净利润

YEAR

The company was approved to set up an overseas company in Hong Kong to carry out aviation and ship leasing business . The company stands out among Chinese leasing companies to acquire the license for the first time.

To finance the first offshore wind farm with ultra unit capacity in China. The project is capable of providing over 1.6 billion kwh annually, which could save about 500,000 tons of standard coal and decrease CO2 emission by over 1.36 million tons when it is put into production.

The company provide engine finance lease to Norwegian Air Shuttle, which is the first offshore engine finance lease deal in China.

Succeed in signing ship financing agreement with top-notch companies and then novate it. It is profitable break-through in marketing and shipping asset management.

CCB SHIPPING AND AVIATION LEASING CORPORATION LIMITED was established in Hong Kong with 300 million USD registered capital.

Theme year of work style improvement.

Cooperate with a downstream supply chain subsidiary under a COE to carry out repurchase of residual value through vendor leasing model.

Vendor leasing for 20 shield tunneling machines in total.

Green leasing increases to a historical high level in light of total funding, proportion and transaction numbers. For our outstanding performance among 121 financial institutions in the industry, the company wins the highest grade “Excellent” in green financing rated by PBOC Beijing branch.

Finance three LNG vessels for two top tier COE shipping companies.

YEAR

The Company published the guideline for distributed photovoltaic business completed the first transaction.

The Company completed ESG green financing withdrawal with Societe Generale, achieving the first ESG green financing.

The Company successfully completed the refinancing of two aircrafts and for the first time fixed the long-term dollar financing rate at a level lower than the US T-bound rate of the same period.

The Company's inclusive leasing platform was put into operation.

The Company's leasing cloud system was connected with China Movable Property Registration System. The first leased asset was automatically registered through the leasing cloud system.

The Company financed logistics vehicles for the first time, which expands its green vehicles business.

The Company's first commercial vehicle inclusive leasing business was successfully completed through the inclusive leasing platform, which was an icebreaking achievement for inclusive leasing business with individuals.

The Company launched the one-year “Internal Control Compliance Management & Construction Year of Leasing Business” activity to further improve the system, optimize the process and strengthen the control.

The Company financed more than 40,000 green vehicles.

The Company completed the re-marketing of the first aircraft whose domestic operating lease had expired, becoming the first Chinese financial leasing company to successfully enter the world's top three aviation logistics groups.

The Company signed the first phase contract of aircraft asset management with JIC Leasing, which was the first time to carry out third-party aircraft asset management business.

At the 14th China International Aviation & Aerospace Exhibition, the Company officially signed firm orders for 50 C919 aircrafts and 10 ARJ aircrafts with the Commercial Aircraft Corporation of China Ltd.

The Company completed the re-marketing of the first aircraft whose overseas operating lease had expired, entering into the Canadian market for the first time.

The second phase of the Company's digital operation and management decision system was put into operation, which adds functions of ship asset management and aircraft and ship asset monitoring.

The company signed a contract with Shandong Marine Group on wind power installation ship leasing project, achieving a breakthrough in wind power ships.

The Company financed 426 business transactions during the year, which was a big leap from 100 to 400.

YEAR

The Company’s digital operation command room was put into operation for the first time.

The Company publicly issued three tranches of RMB financial bonds in the interbank market for a total amount of RMB 7 billion.

The Company has financed more than 30,000 new energy vehicles.

The Company took the initiative to get out of its comfort zone based on the actual situation, by implementing its new financial actions to advance green leasing transformation, inclusive leasing transformation, and digital transformation, and return to its original roots of leasing.

The Company signed an agreement for its first vessel export & operating lease transaction through SPV in domestic free trade zones.

The company landed its first parent-child linkage business with CCB Hainan Branch, and the scope of the domestic linkage was expanded to include 35 primary branches.

The Company launched its standardized data acquisition system (EAST).

The Company signed an agreement for its first vessel export & financial lease transaction through SPV in domestic free trade zones.

Phase II of the Company's leasing cloud project has been accepted.

A new version of the Company's financial management system (NCC) went online.

The Company signed an agreement for its first vessel offshore operating lease transaction through SPV in domestic free trade zones.

YEAR

The Company actively implemented the COVID-19 prevention and control policies by taking advantage of its licenses and permits to fight the “pandemic” and responding rapidly to leasing demands.

Upon the approval from Beijing Office of the China Banking and Insurance Regulatory Commission, the registered capital of the Company was increased from RMB 8 billion to RMB 11 billion.

The Company developed and implemented 27 measures to prevent and control the COVID-19 pandemic and to promote the quality economic growth through the resumption of work and production.

The Company adapted its business strategies to expand domestic market and enhance risk-control in foreign market to overcome the effects of the pandemic.

Phase I of the Company's leasing cloud platform went online.

The first batch of phase II of the Company’s leasing cloud platform was put into operation.

YEAR

The Company successfully completed delivery financing for the first time.

The Company ranked 27th among 2018 TOP 50 Global Aircraft Leasing Companies.

The Company successfully entered into the Norwegian market by signing a financial lease agreement with the world's largest operator of floating gas storage and regasification vessels.

The Company completed its first direct lease on a cash discount basis.

YEAR

The Company issued the first tranche of financial bonds of RMB 6 billion in 2018 in the interbank bond market in China.

The Company signed a letter of intent to cooperate with some public hospitals in Ankang at the signing ceremony of “CCB's Charitable and Poverty Reducing Efforts in Ankang”.

The Company signed a letter of intent to cooperate with some public hospitals in one district and three counties in Ankang for targeted poverty alleviation.

The Company successfully issued the second tranche of financial bonds of RMB 3 billion in 2018.

The Company issued the third tranche of financial bonds of RMB 3 billion in 2018.

YEAR

The Company successfully issued the first tranche of 2017 leasing ABS project with a total amount of RMB 1.214 billion.

The Company launched its first T+0 direct leasing factoring transaction business.

The Company completed the first direct finance lease factoring transaction with a pre-lease period.

The Company's first A320NEO aircraft with Air China Limited landed at Beijing Tianzhu Comprehensive Bonded Zone, marking “a zero breakthrough" in the cooperation with Air China.

The Company signed a strategic agreement with Dongfeng Electric Vehicle Co., Ltd. at the event “Cooperation and Opening Ceremony for Key Projects of China Construction Bank and Its Ten Subsidiaries to Support the Construction of Wuhan as An International Center City and the Yangtze River New City”.

Tenth anniversary of the Company.

YEAR

The Company delivered its 100th aircraft.

Moody's upgraded the Company's international rating from A2 to A1, with the adjusted rating matching CCB's.

The Company was qualified to engage in ABS business.

The Company issued RMB financial bonds of RMB 5 billion in the domestic interbank bond market for the first time.

The Company signed strategic cooperation agreements with 8 key customers in Guizhou Province at the "Promoting Guizhou's Poverty Alleviation - Multi-Party Cooperation Agreement Signing Ceremony for Attracting Capital to Guizhou".

For the first time, both the net profit and the ROE of the Company were in the double-digit percentage range.

YEAR

Upon the approval from Beijing Office of the China Banking and Insurance Regulatory Commission, the registered capital of the Company was increased from RMB 4.5 billion to RMB 8 billion.

The Company has been awarded a long-term issuer rating of A2/A/A by three international rating agencies, including Moody's, S&P and Fitch, all with a stable outlo.

The Company entered the "first tier" of financial leasing companies with total assets exceeding RMB 100 billion.

YEAR

The Company signed a two-year strategic cooperation agreement with BYD Group, a leading developer and manufacturer of new energy vehicles, for a total of RMB 10 billion in production and sales.

The Company successfully raised its first domestic syndicated loan of USD 175 million.

YEAR

Upon the approval of China Banking Regulatory Commission for the change in the shareholding structure of the Company, the Company became a wholly-owned subsidiary of CCB and changed its name to CCB Financial Leasing Co., Ltd.

YEAR

The Company signed the C919 Passenger Aircraft User Agreement with Commercial Aircraft Corporation of China, Ltd. in Beijing to order 50 C919 passenger aircraft.

China Construction Bank completed closing procedures to acquire Bank of America’s 24.9% stake.

YEAR

The Company carried out a comprehensive review of the quality of leased assets for all existing customers in order to further strengthen post-leasing management and improve the targeting of risk management measures.

YEAR

The Company was qualified to set up SPV in domestic free trade zones to conduct financial leasing business.

The first single aircraft project company, established by the Company in Beijing Tianzhu Comprehensive Bonded Zone, Shunyi District, Beijing, obtained a business license to engage in aircraft leasing.

The first single vessel project company, established by the Company in Tianjin Dongjiang Bonded Port, obtained a business license to engage in vessel leasing.

YEAR

The Company became a member of the China Banking Association Financial Leasing Committee.

The Company entered the national interbank lending market and started to engage in interbank lending business.

YEAR

The Company entered into a sale and leaseback finance lease agreement with Huaneng Lancang River Hydropower Inc. for hydro turbine generator sets of Xiaowan Hydropower Station. This transaction was the first of its kind for the Company and was also the largest transaction among its domestic leasing peers at the time in terms of independently designed products, independently completed transactions, single lease contracts, and payments.

YEAR

CCB Financial Leasing Co., Ltd. (the "Company") was registered and incorporated in Beijing with a registered capital of RMB 4.5 billion, jointly funded by China Construction Bank and Bank of America, of which CCB holds 75.1% and Bank of America 24.9%.

The Company’s opening ceremony was held in the presence of relevant leaders from the China Banking Regulatory Commission and the Beijing Municipal Government, Guo Shuqing, then Chairman of China Construction Bank, Zhang Jianguo, President of China Construction Bank, officials from relevant government departments and representatives from major domestic and foreign companies in the energy, aviation, shipping and financial sectors.

COMAC AOXIANG Best Financial Support

COMAC Customer Conference in 2023

Best Innovation (Offshore Engine Finance Lease Deal with Norwegian Air Shuttle)

The 9th China Air Finance Wanhu Award

Excellent Innovation Case (Offshore Engine Finance Lease Deal with Norwegian Air Shuttle)

The 3rd China Finance Lease Innovation Conference

2021 Outstanding Bond Issuers in CCDC Members' Business Development Quality Assessment

China Central Depository & Clearing Co., Ltd.

China Maritime Finance “Qianxing” Award - Pioneering Award (Finance Leasing Project for Petredec’s 4 New-Built 84,000 cbm LPG Carriers)

The 6th China Maritime Finance “Qianxing” Award

Gold Financial Leasing Company of the Year

The 11th "Golden Pixiu Award" in 2020

Innovative Vessel Financing Deal of the Year (Finance Leasing Project for Mediterranean Shipping Container Vessels)

Crédit Agricole Corporate and Investment Bank

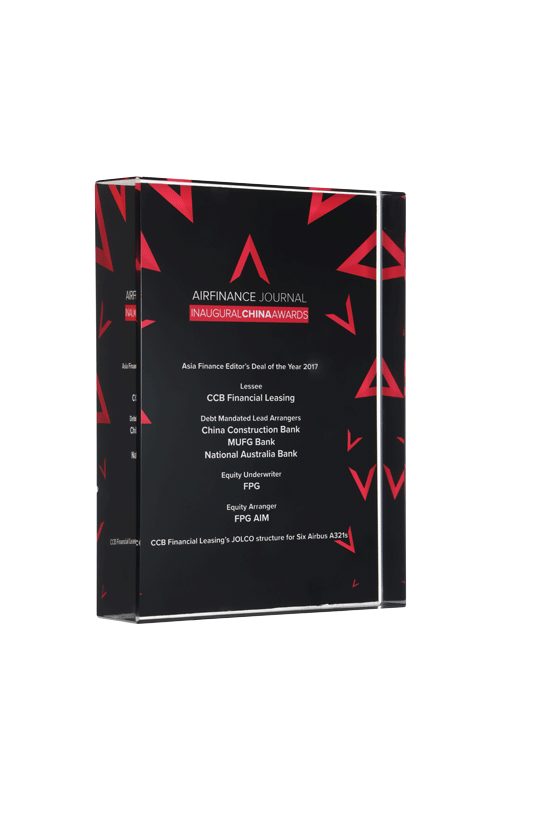

2020 Best Used Aircraft Deal of the Year (Thomas Cook Risk Disposal Project)

Airfinance Journal

2020 Best Deal of the Year in the Equity Category (Norwegian Air Aircraft Order Project)

Journal of Aviation Economics

2020 Best Deal of the Year (Shandong Airlines Asset Return and Southern Airlines Asset Package Project)

The 8th China Air Finance “Wan Hoo” Awards

Strategic Synergy Leader in Banking and Leasing

2020 (the 7th) China Financial Leasing "Soaring Award"

2019 Best Domestic Financing Deal Award (Xiamen Airlines Dual Currency Financing Project)

Airfinance Journal

Ten-Year Industry Contribution Award of China Aviation Finance

The 7th China Air Finance “Wan Hoo” Awards

Outstanding Financial Bond Issuers

2018 Outstanding Member of China Bond Market

Industry Promotion Award

The 6th China Air Finance “Wan Hoo” Awards

Gold Financial Leasing Company of the Year

The 9th "Golden Pixiu Award" in 2018

Best Risk Control Leasing Companies

2018 China Financial Leasing Soaring Award

Asian Finance Deal of the Year (Daily Tax Aircraft Financing Project, Wizz, Thomas Cook Airlines)

China Air Finance and Leasing Awards of the Airfinance Journal

License of "Five-star” Enterprise

Comprehensive Rating of Leading Enterprises in Tianjin Dongjiang Management Committee

Gold Financial Leasing Company of the Year

The 8th Annual China Financial Management "Golden Pixiu Award" in 2017

Innovation Award

The 3rd China Maritime Finance (DFTP) Summit

2016 Outstanding Financial Bond Issuers in China Bond Market

2016 Outstanding Member of China Bond Market

Innovation Award for First Orphan Trust Structure Direct Finance Leasing

The 2st China Maritime Finance (DFTP) Summit

2016 Advanced Group of Parent-Child Synergistic Linkage

Bank-wide Subsidiary Work Conference

Innovation Award for First Domestic Vessel Offshore Leasing Transaction

The 1st China Maritime Finance (DFTP) Summit

Innovation Award for First Legal Tax Financing

The 3rd China Air Finance Awards

Top 10 Enterprises in China's Financial Leasing Industry in 2014

Annual China Leasing Conference

List of Outstanding Contributions of China Banking Association Financial Leasing Committee

China Banking Association

2012 China Top 10 Innovative Shipping Support Enterprises

China Shipping Annual Gala

2010 China Top 10 Financial Leasing Companies

Annual China Financial Leasing Conference

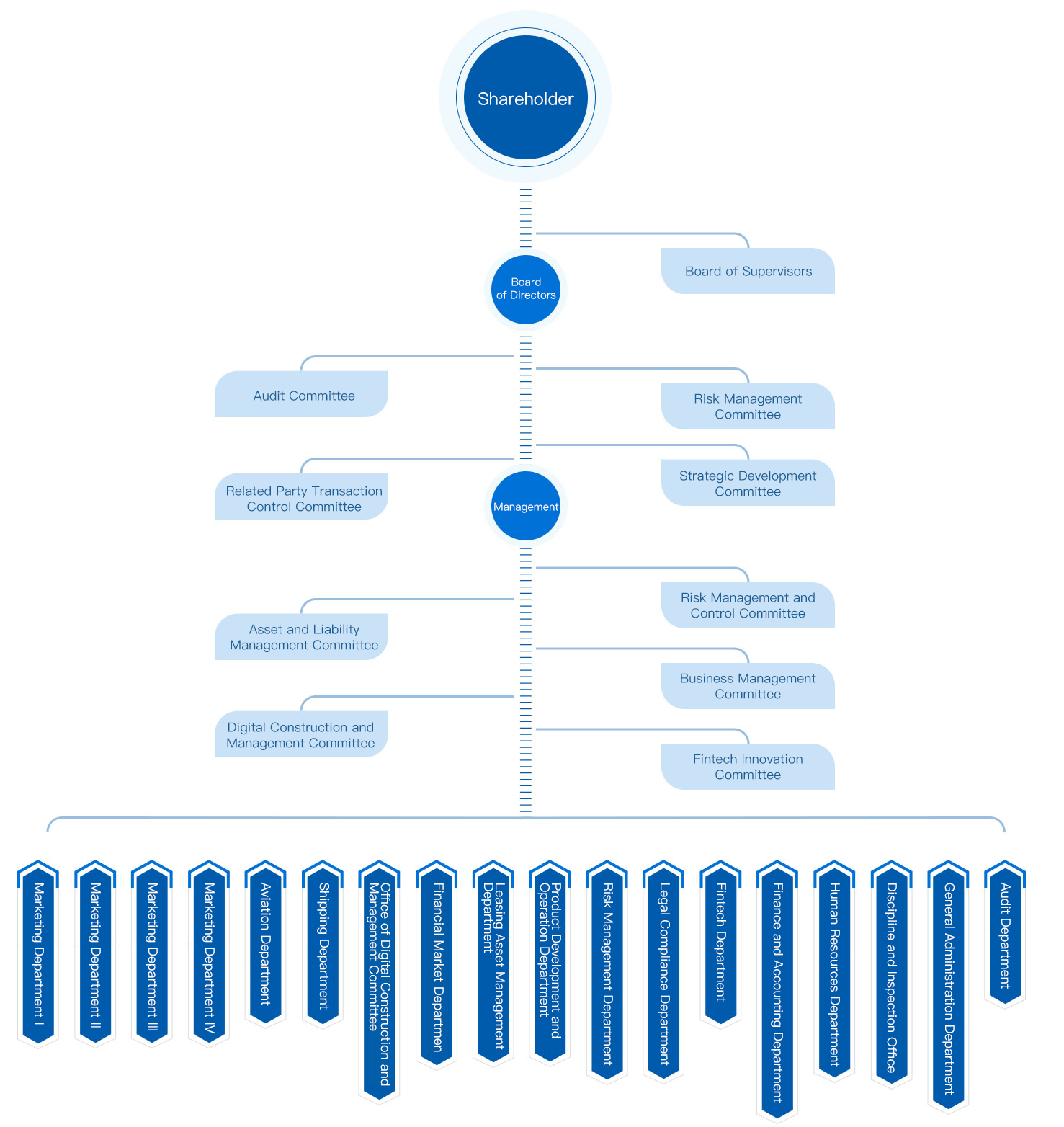

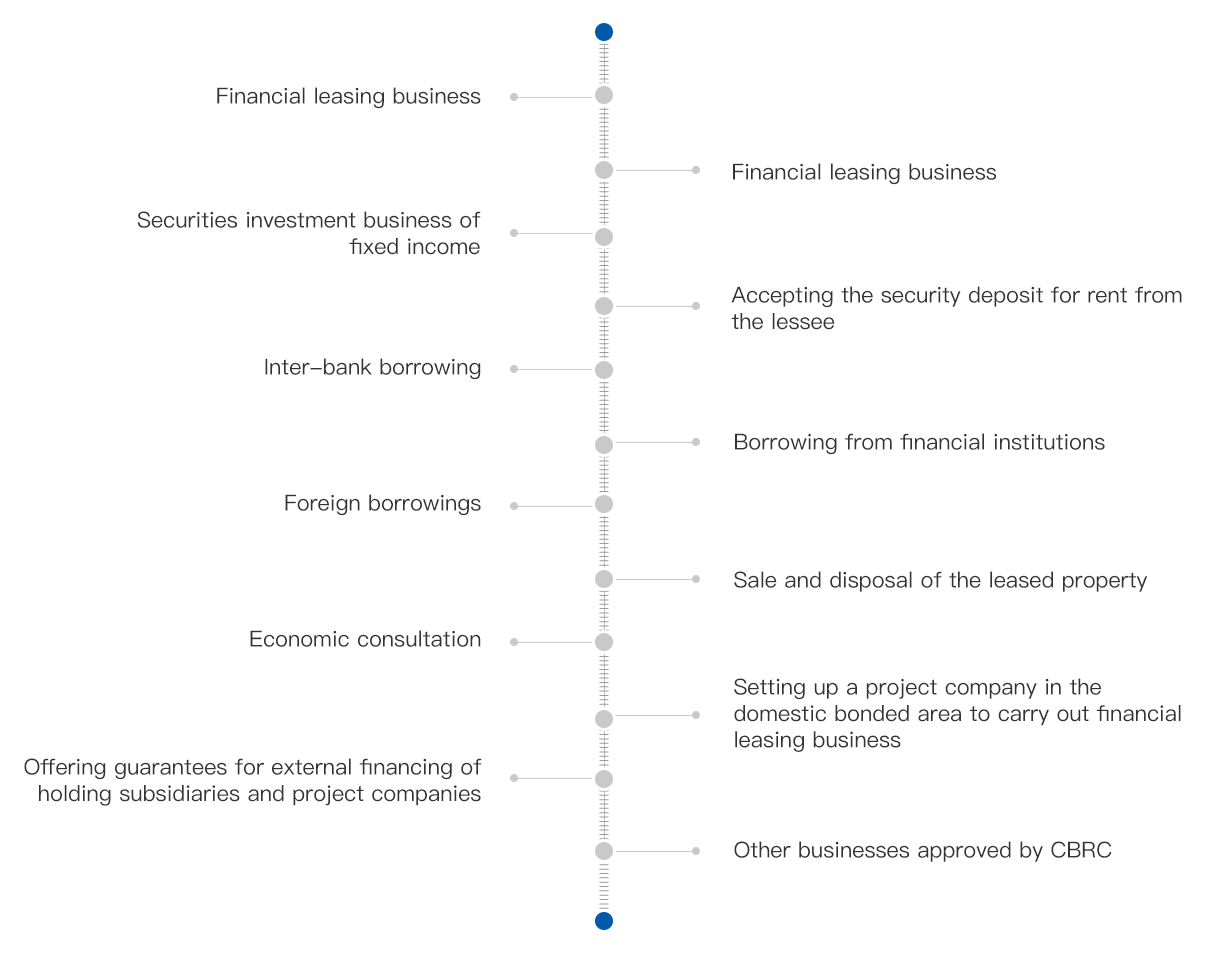

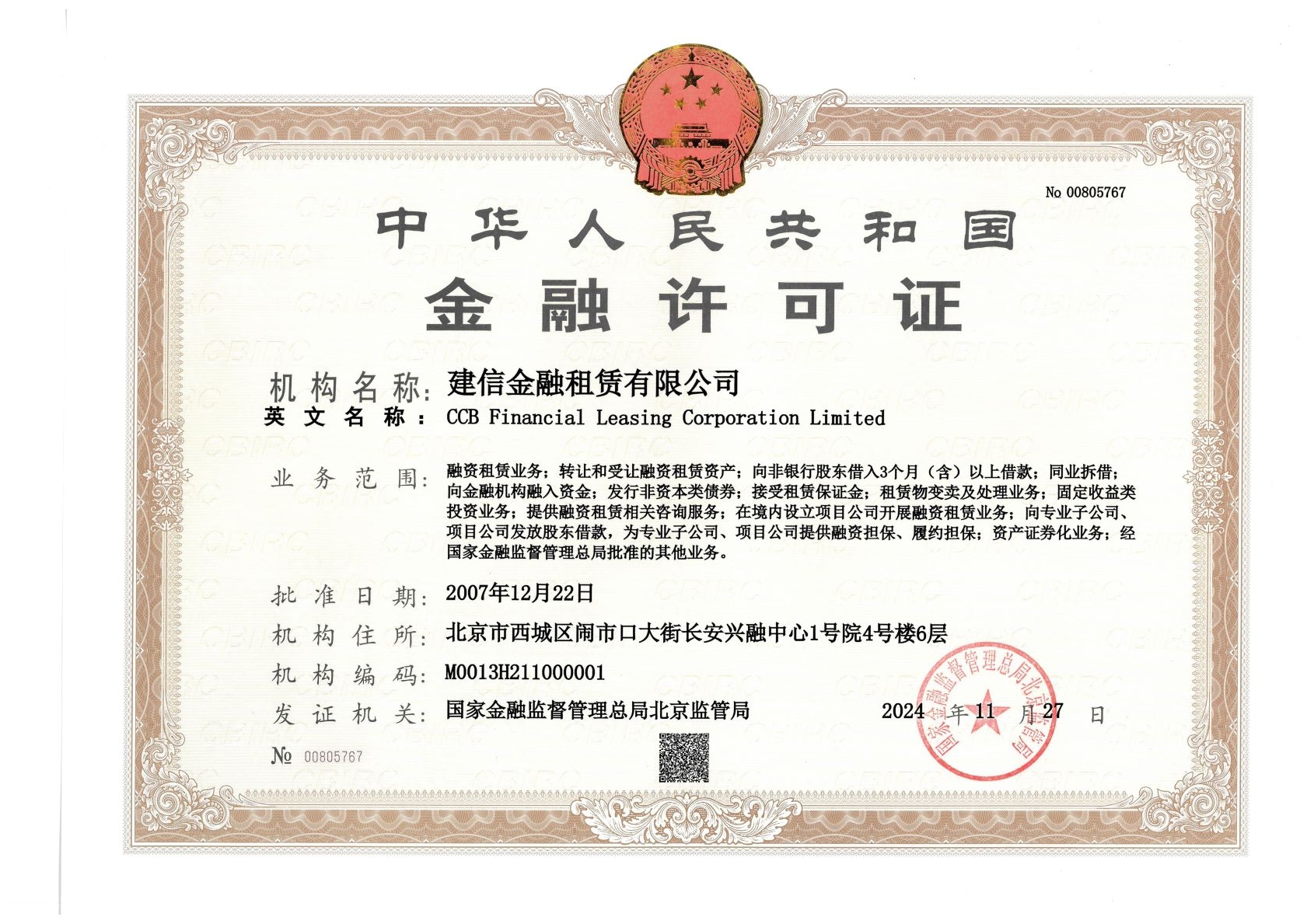

Company Name: CCB Financial Leasing Co., Ltd.

Legal Representative: Tao Song

Business Area:Nationwide

Business Scope: Finance lease business; transferring and acquiring assets subject to financial leases; investing in fixed-income securities; accepting lease deposits from lessees; interbank lending; taking loans from a financial institution; overseas borrowing in foreign currencies; sale and disposal of leased property; economic consultancy; establishment of project companies in domestic bonded zone to engage in leasing business; providing guarantee for external financing of holding subsidiaries and project; issuing financial bonds upon approval; engaging in ABS business; other businesses approved by CBRC.